On a searingly sunny day in 1978, Brazil football superstar Rivelino stepped off a Concorde aeroplane in Riyadh to a massive roar from thousands of fans waving the flag of Saudi Arabian club Al-Hilal.

He was ushered to a Rolls Royce and taken to a luxurious royal palace, where he was treated to a banquet hosted by members of the Saudi royal family.

The Brazil legend was, alongside Pele, a standout of the 1970 World Cup-winning side that is widely viewed as the greatest national team in history. When Saudi Arabia came calling in ‘78, he boasted 100 caps for the national team and wore the captain’s armband.

Watch every match of The ICC Men’s Cricket World Cup Live on Kayo Sports. Starts THU 5 OCT 7:30PM AEDT. Join Kayo now and start streaming instantly >

On that evening in Riyadh, he inked his signature on a multimillion-dollar contract that came with lavish bonuses: a brand-new Mercedes, a $10,000-a-month living allowance, and a royal’s palace in which to live.

One of the world’s finest and most well-known players had been wooed by money and luxury.

Forty-five years later the parallels are clear. Saudi Arabia is again embarking upon a transformational project to boost its local sporting industry and shake up the established global order, and football is at its core.

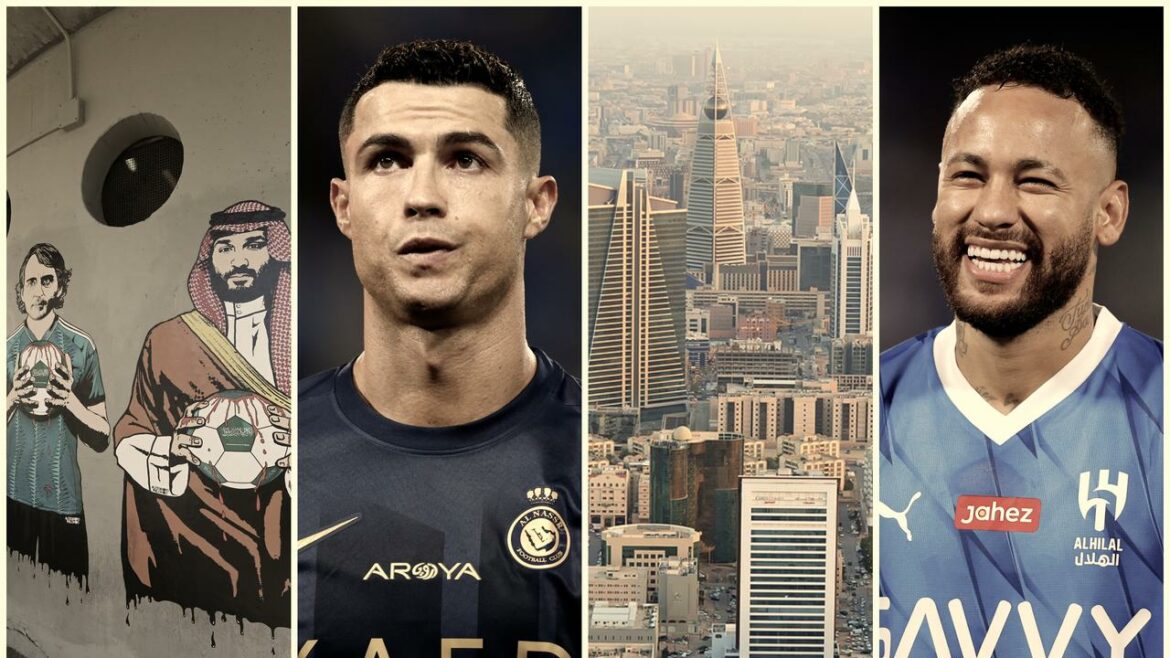

Instead of Rivelino, it’s Ronaldo. Cristiano, one of the greatest players of all time and one of the most famous figures in world sport, began an exodus of top players to Saudi Arabia when he signed for state-owned Al-Nassr in January for a reported €200 million ($A330 million) per year.

Like Rivelino, Ronaldo was the first drop in what has quickly become a flood – one that some believe poses an ‘existential threat’ to the traditional leagues of Europe including the Premier League.

Indeed, in the just-concluded transfer window, only the Premier League spent more money on transfer fees than the Saudi league’s combined $1 billion-plus USD outlay.

It’s a staggering figure, especially since the overwhelming majority came straight from government coffers – and it doesn’t include the staggering world-record wages being doled out. Wages included, Saudi Arabian teams may have even spent more than the Premier League this year.

The story of Saudi Arabia’s sporting investment began in 1978, but it’s just getting started. And it’s already having a massive impact on the world of sport.

HOW MUCH IS SAUDI ARABIA SPENDING … AND ON WHAT?

From January 2021 to July 2023, the country spent at least $6.3bn USD ($A9.74bn) on sports, according to data from The Guardian. It represents an exponential growth on the estimated $1.5bn the nation spent on the industry between 2014 and early 2021, based on analysis from Grant Liberty.

It’s a mind-blowing outlay, but the real figure of their recent spending is likely even higher given a shroud of secrecy surrounds the investment activities of the nation’s Public Investment Fund and its reported $620 billion USD in assets.

But what is evident is that the nation isn’t just targeting one sport, but investing in almost every code you can imagine – from motorsports to horseracing, boxing to handball, tennis to chess.

WWE wrestling events have been held in the nation since 2014, while the desert nation has even turned its attention to winter sports, reviving the Asian Winter Games that have not been held since 2017 with a successful bid to host the games in 2029.

That’s despite the winter temperatures at the proposed hosting location going down to minimums of just three degrees – hardly ideal for snow sports.

But when money is no object, even the weather isn’t a problem.

A general view over the F1 circuit in Jeddah, Saudi Arabia.Source: Getty ImagesEven Esports are in the sights of the Saudis. The Guardian’s $6.3bn USD appraisal of Saudi Arabian sports spending didn’t include the billion dollars PIF invested in video game company Embracer Group, or the eight per cent stake they picked up in Nintendo, as well as multiple major events being held in the nation.

All this is to show the sweeping breadth of Saudi Arabia’s stratagem – one as calculated as it is audacious.

“This is a sports strategy that is as comprehensive and more detailed than any other in the world,” a sporting executive told The Guardian under the condition of anonymity. “It is not a fad, this is not just some rich man’s whim.”

The first major disruption of the global sporting landscape came in October 2021 when the PIF founded LIV Golf, a rival to the PGA Tour that quickly handed out astronomical pay cheques to convince players to defect.

Phil Mickelson was paid a reported $200 million USD in guaranteed money and Dustin Johnson $125m, with Forbes claiming half of each player’s figure was paid upfront. Tiger Woods was offered around $700-800 million. All up, LIV cost an estimated $2 billion USD to found.

It sparked a golfing civil war, with verbal barbs and lawsuits being fired back and forth like archers’ volleys. But the Saudis would not relent, and the bitter dispute appears headed to a civil conclusion that will see a new organisation formed to unite golf under one banner – with Saudi Arabia to gain at least a minority stake to the tune of at least another billion dollars.

The long-running and high-stakes LIV saga explains much of Saudi Arabia’s strategy to reshape the sports world: to disrupt the established order with spending that cannot be matched by the traditional authorities, forcing them to make major concessions – and to cede a significant degree of influence and power to the Middle Eastern monarchy.

LIV Golf’s Phil Mickelson.Source: AFPThat approach has now also been taken towards boxing and mixed martial arts, with the Saudis reportedly investing $100 million USD into a UFC rival in the Professional Fighters League, the body which has recently signed superstar fighters Francis Ngannou and Jake Paul. Saudi Arabia is expected to host multiple PFL pay-per-view events in 2024.

In other cases, Saudi Arabia is happy to use its money to operate within the established structures, rather than seeking to create or back opposing competitions.

In December, the ATP’s Next Gen finals will be held in Jeddah after a four-year deal to host the year-end tennis tournament.

In Formula One, another key focus of Saudi Arabia’s sporting investment, Saudi Arabia pays a reported $65 million USD to host a grand prix in Jeddah each year. But it also sponsors Formula One to the tune of $40-45m annually, as well as the Aston Martin team, both through the Saudi state-owned company Aramco. Aramco is the world’s largest oil company and the world’s second-largest company by revenue, with an annual revenue over half a trillion USD.

That funding also isn’t included in the Guardian’s estimate of $6.3bn USD spent by Saudi Arabia on sports since early 2021. Nor is their deal with the International Cricket Council that makes Aramco title sponsors of every ICC event including the upcoming Cricket World Cup. Aramco also has a partnership with Chinese basketball and is the backer of a fledgling women’s golf tour.

It’s not just the PIF that is pouring money into sports – the nation is using every financial arm at its disposal to grow its stake in the world of sport.

For all the sports the nation has invested in, there’s no doubt that football remains at the core of their strategy.

The primary reason is simple: it’s the most popular sport in Saudi Arabia – and the world.

WHAT HAPPENED IN FOOTBALL?

Saudi Arabia really announced themselves in the world of football when they purchased Premier League club Newcastle in October 2021 for around £300m, having strongly considered a takeover of Manchester United in the months before that deal was confirmed.

The nation had brought some major football events to Saudi soil before then – the Spanish Super Cup has been played in Jeddah since 2019 – but this was a major step forward.

The PIF then signed sponsorship deals with Saudi Pro League clubs worth a reported £1.8bn, before taking full control of four of the largest teams, paving the way for an unprecedented spending spree.

Cristiano Ronaldo joined Al-Nassr in January for a reported €200 million per season plus a €100m signing bonus.

It kickstarted a stunning assault on the transfer market by the four state-owned clubs in the recent transfer window that closed earlier this month.

This window, Premier League clubs splashed out a record €2.8 billion on players, with a net spend of €1.278bn. Saudi Pro League clubs were second, spending €956.88m with a net spend of €892m.

The spending is an exponential increase from last season, when the Saudi Pro League’s expenditure was the 20th highest in the world with a net spend of just €34.15m.

This year, they blew that figure out of the water – and their €892m net spend doesn’t even include the extraordinary wages being handed out.

94 foreign players arrived, and the list of high-profile players who joined the four state-owned clubs is immensely impressive.

SIGNINGS FROM FOUR BIGGEST CLUBS

Al-Ahli: Allan Saint-Maximin (Newcastle), Riyad Mahrez (Manchester City), Edouard Mendy (Chelsea), Roberto Firmino (Liverpool), Franck Kessie (Barcelona)

Al-Hilal: Neymar (PSG), Malcom (Zenit St Petersburg), Ruben Neves (Wolves), Kalidou Koulibaly (Chelsea), Aleksandar Mitrovic (Fulham), Sergej Milinkovic-Savic (Lazio)

Al-Ittihad: Karim Benzema (Real Madrid), N’Golo Kante (Chelsea), Fabinho (Liverpool), Jota (Celtic)

Al-Nassr: Sadio Mane (Bayern Munich), Otavio (Porto), Aymeric Laporte (Manchester City), Alex Telles (Manchester United), Marcelo Brozovic (Inter Milan).

In this handout picture release by the Saudi Pro League on June 6, 2023, French football player Karim Benzema holds the jersey of Saudi Arabia’s Al-Ittihad club, in Madrid. Real Madrid’s Ballon d’Or winner Karim Benzema will join Cristiano Ronaldo in Saudi Arabia after signing a three-year deal with Al-Ittihad, the Jeddah-based club confirmed on June 6. (Photo by jorge ferrari / Saudi Pro League / AFP)Source: AFPIn this handout picture release by the Saudi Al-Hilal football club on August 15, 2023, Brazilian forward Neymar (L) poses for a picture with Hilal President Fahad bin Nafel at the Al-Hilal stadium in Riyadh. Brazil forward Neymar has signed for Saudi Arabia’s Al-Hilal from Paris Saint-Germain, the clubs announced today, joining Cristiano Ronaldo and Karim Benzema as the latest big name lured to the oil-rich Gulf state. (Photo by Saudi Pro League / AFP)Source: AFPIn fact, more than 90 per cent of Saudi Pro League spending came from the four clubs owned by the PIF.

Al Hilal’s €351.72m net spend was more than any other club in the world, while Al-Ahli was second with €195.75m – just above Chelsea.

Meanwhile, four rival Saudi clubs broke even or made money. Another four had a net spend less than €2m.

Sure, a couple of the privately-owned clubs did spend money. Al Ettifaq signed Jordan Henderson, Georginio Wijnaldum, Moussa Dembele and Demarai Gray, as well as the legendary Steven Gerrard as coach. But their net spend was still just €36m.

Al Shabab spent around €15m, signing the likes of Habib Diallo and Yannick Carrasco.

Outside of that, you’d need to be something of a football nerd to recognise any other names who joined the Saudi league.

Effectively, four clubs are spending like Premier League giants, and another two like minnows from the top five leagues. The rest are still operating on a relatively minuscule budget. This isn’t an entire league outspending the rest of Europe, but rather a handful of clubs with almost unlimited funding – and no financial fair play rules to follow.

ARE THEY JUST BUYING HAS-BEENS?

There was another key trend in the biggest clubs’ spending – age. The majority of signings were players in their late 20s or their 30s, ones with prestige and popularity and plenty of skill to boot.

Ronaldo is 38, reigning Ballon d’Or winner Karim Benzema 35, Jordan Henderson 33, and so on.

Many of the players remain in the prime of their careers, however, and Saudi clubs fought off interest from even Premier League clubs or heavyweights like Barcelona to sign them.

That was the case for players like Aleksandar Mitrovic, Ruben Neves, and Sergej Milinkovic-Savic.

But if you look at younger players, Saudi Arabia is not an attractive destination – yet.

According to the player grading system from Twenty First Group consultancy, Saudi clubs signed just two of the 100 best players under 26 years old that moved this transfer window.

That’s compared to the SPL signing 15 of the top 100 players overall that moved this window (second to the Premier League’s 28).

Aleksander Ceferin, the head of European football’s organising body UEFA, took aim at the Saudi transfers by saying they were only landing “players at the end of their careers and others who aren’t ambitious enough to aspire to the ‘top’ competitions.”

“As far as I know, [Kylian] Mbappe and [Erling] Haaland don’t dream of Saudi Arabia,” he added.

“I don’t believe that the best players at the pinnacle of their careers would go to Saudi Arabia.

“When people talk to me about the players who went there, nobody knows where they’re playing.”

Saudi Arabia’s Al-Hilal had a world-record €300m bid rejected for Mbappe – plus a one-year contract with a basic wage worth €200m alongside up to €700m in commercial and image rights.

The 24-year-old’s refusal to even talk with Al-Hilal shows that for elite young players, Saudi Arabia isn’t an attractive footballing proposition. And all the money in the world isn’t enough to convince players to give up on playing for the world’s biggest clubs.

For now, the majority of players that Saudi Arabia has signed are high-profile ageing stars. But as the quality of the competition grows – and it certainly has already – European leagues will become increasingly fearful that young talent will be lured by money as well as the chance to play alongside the likes of Ronaldo or Neymar.

Watch every match of The ICC Men’s Cricket World Cup Live on Kayo Sports. Starts THU 5 OCT 7:30PM AEDT. Join Kayo now and start streaming instantly >

WHAT’S THE POINT?

There are two core reasons: to diversify Saudi Arabia’s economy, and to improve the nation’s global reputation and influence.

Saudi Arabia has long relied on oil as the basis of its economy. It is the world’s second-largest producer of oil, and the industry currently contributes around 40 per cent of the nation’s GDP.

That reliance leaves the country vulnerable to fluctuations in the oil price and especially the world’s anticipated reduction in oil usage in response to climate change.

As Simon Chadwick, professor of sport and geopolitical economy at the Skema Business School in Paris, told AFP: “Saudi Arabia is up against the clock.

“Saudi Arabia has 20 years to diversify. In the meantime they’re being exposed to oil-price fluctuations.

“They’ve got to move fast, they’ve got to move strategically, they’ve got to move effectively.”

In response to this pressing need, Saudi Arabia in 2016 launched a plan for long-term reform called Vision 2030, a programme of sweeping reforms to diversify the economy and reduce its dependence on oil revenue.

The modernisation project is immensely broad-reaching and ambitious – it aims for radical economic development by increasing foreign investment and growing new industries such as transportation and entertainment – including sport.

There’s also government-funded mega-projects like NEOM, a futuristic megacity which includes a 160km-long skyscraper and is estimated to cost over $500 billion USD.

In this broader context, sport is just one aspect in an all-encompassing restructuring of the economy.

But sport is an industry with massive potential for growth and can drive domestic and foreign tourism – especially if they host major events like the FIFA World Cup, which they are hoping — and appear likely — to land in 2034.

And it has a social impact too – making the nation a more appealing place to live, especially since almost two-thirds of the population is aged under 30.

At the same time as this crucial economic restructuring, Saudi Arabia is also seeking to enhance its global reputation – something which can encourage foreign investment, tourism, and boost the nation’s influence on the world stage through so-called ‘soft power’.

The country has been broadly condemned for its poor human rights record, such as its routine use of the death penalty, with global human rights organisation Amnesty International reporting 196 people were executed in 2022.

Migrant workers have suffered exploitation and abuse – including in the building of government megaprojects like NEOM – while immigrants have also allegedly faced torture and death in detention centres.

Human rights activists have faced exceptionally long jail terms, including Salma al-Shehab, a PhD student who in August 2022 imprisoned last year for 34 years for tweeting in support of women’s rights.

The country has taken some steps forwards in terms of women’s rights since 2019, including reducing strict dress codes and gender segregation in the workforce. But the entrenched system of male guardianship still poses major problems with regards to gender-based discrimination in domestic life, activists say.

Same-sex activity also remains outlawed.

And one of the defining incidents when it comes to Saudi Arabia’s human rights record remains the murder and dismemberment of US-based journalist Jamal Khashoggi in October 2018, who had been critical of the Saudi government. It caused an international scandal, and US media reported the CIA concluded with “medium to high confidence” that the killing had been ordered by the nation’s leader Mohammed Bin Salman himself.

The country has sometimes been made a global pariah due to its human rights record, which has obvious impacts on a range of economic factors too – such as limiting tourism and foreign investment from both private companies and foreign governments.

By investing heavily in sport, Saudi Arabia can associate itself with the positive characteristics of sport and divert attention from their poor human rights record – a tactic known as ‘sportswashing’.

The approach has been widely used by other countries in the past, from nations such as Nazi-era Germany, or Russia and China in more recent times. But Saudi Arabia’s spending is unprecedented in scale.

When Premier League club Newcastle United was bought out by the PIF for 300m pounds in 2021, Amnesty UK’s chief executive, Sacha Deshmukh, said the deal was “a clear attempt by the Saudi authorities to sportswash their appalling human rights record with the glamour of top-flight football”.

But some experts believe that sportswashing isn’t the primary point at all, and instead believe the Saudis are almost completely focused on their economic goals.

Princeton professor Bernard Haykel, author of a book on Saudi Arabia’s economic transformation under the Vision 2030 plan, recently spoke on The Afikra Podcast.

He rejected claims that Saudi Arabia was sportswashing, saying: “I think it’s a crock of you know what”.

Ali Khalid, sports editor of Riyadh-based Arab News, told AFP that: “Cynics will say what are the reasons behind it,” referring to sportswashing.

“But a lot of it is they’re bringing to their people, who for a long time had no access to any entertainment of that level, they’re bringing the best of it.”

And Crown Prince Mohammed Bin Salman this week delivered a rare television interview with Fox News where he played down accusations of sportswashing.

Bin Salman said: “If sportswashing is going to increase my GDP by one per cent, then we’ll continue sportswashing.

“I don’t care. I have one per cent growth in GDP from sport and I am aiming for another 1.5 per cent.

“Call it whatever you want – we are going to get that 1.5 per cent.”

WHAT IS THE LEAGUE LIKE – AND HOW ARE THINGS CHANGING?

Last month star signing Neymar made a staggering appraisal.

“For the names that went to Saudi Arabia, I wouldn’t be surprised if the Saudi league is better than the French,” Neymar declared.

That’s right – already better than one of the top five leagues in the world, which began back in 1932-33 as a professional competition.

There’s no doubt that the Saudi league has come a long way since the days when Rivelino joined in 1978, just two years after the competition was founded.

“It was almost amateur football at the time as football was really just starting there,” Rivelino said in an interview with Brazilian television in 2019.

“We trained at the same stadium in which we played the games. There were three teams in Riyadh and so we trained from 6 to 7pm, the next team from 7 to 8 and then the third from 8 to 9.”

Then there was the heat – the Brazilian famously played with a wet cloth in his mouth for his first few games to counteract the oppressive conditions. Not that that stopped him from showing his immense skills on the field, leading the team to a league title with just one defeat in his debut season, before winning the King’s Cup in his second year and scoring 23 times before retiring.

These days, the league is fully professional – though it reached that milestone just 16 years ago, a drop in the ocean of time compared to historic European football competitions.

But the league has been highly successful when compared to Asia – in the Asian Champions League, only South Korea and Japan have won more titles than teams from Saudi Arabia. Al-Hilal’s four titles and five runners-up finishes are both records.

That said, the competition is a world away from the likes of the Premier League. Last year, crowd sizes averaged around 10,000 per game. Compare that to the Premier League or the Bundesliga, both averaging over 40,000 fans per game last season. Italy, Spain, France, and even Mexico all had over 20,000 fans per game.

JEDDAH, SAUDI ARABIA – SEPTEMBER 30: Jordan Henderson of Al Ettifaq claps after Saudi Pro League match between Al Ahli and Al Ettifaq at Prince Abdullah Al Faisal Stadium on September 30, 2023 in Jeddah, Saudi Arabia. (Photo by Yasser Bakhsh/Getty Images)Source: Getty ImagesJEDDAH, SAUDI ARABIA – SEPTEMBER 30: Steven Gerrard coach of Al Ettifaq claps after Saudi Pro League match between Al Ahli and Al Ettifaq at Prince Abdullah Al Faisal Stadium on September 30, 2023 in Jeddah, Saudi Arabia. (Photo by Yasser Bakhsh/Getty Images)Source: Getty ImagesBut there’s no doubt that the arrivals of the star names have increased interest in the competition.

In the 21/22 campaign Al Nassr averaged 8,121 fans. Last season – where Cristiano Ronaldo joined halfway through – they averaged 17,638 fans. A full season of Ronaldo and his new supporting cast is likely to improve that figure significantly.

There’s also greatly expanded interest overseas, with more nations around the world broadcasting the competition – including regional rivals Iran for the first time ever.

The competition is growing. Fast.

WILL IT LAST?

The biggest question is whether the Saudi spending spree is sustainable or a flash in the pan, a short-lived tactic destined for failure.

After all, this isn’t the first time that nations have splashed the cash in an attempt to muscle in on a slice of the rich footballing pie.

Go back to the 1970s, when the North American Soccer League (NASL) exploded in popularity after Brazil legend Pele signed for the New York Cosmos (owned by Warner Media) in what author Gavin Newsham called “the transfer coup of the century”.

That team later signed Franz Beckenbauer and Carlos Alberto and averaged over 40,000 fans a game for three seasons! Other NASL teams landed the likes of Johann Cruyff and George Best. But by 1985, the league was dead and buried – once Pele retired, the league died a slow death as popularity waned and economic recession struck.

There was a similar story in China over the last decade or so, after the government announced a desire for the nation to become a global powerhouse in the sport. From 2011 onwards, Chinese business magnates bought teams like Guangzhou Evergrande and spent millions on superstar signings.

Chelsea legend Didier Drogba was one of the first to go, before things peaked in 2016-17’s winter transfer window when Chinese Super League teams spent a world-leading €388 million on players. That included the December 2016 signing of Chelsea’s Brazilian midfield gun Oscar for over €60 million by Shanghai SIPG. Like Saudi Arabia, and like the NASL before it, China convinced players to sign on simply by offering them massive pay packets.

Then-Chelsea coach Antonio Conte warned that the rise of China was a “danger for all teams in the world” – something that’s been said almost word-for-word about the Saudi Pro League this year.

But the priorities of the Chinese government turned. Concerned about the massive amounts of money going to foreign teams around the world (as well as foreign players and agents), the Chinese government in 2018 introduced transfer taxes and salary caps. The league quickly nosedived.

Billions of dollars of transfer spending had little long-term impact. And China’s men’s national team is currently ranked just 80th in the world – worse than in 2011 when the project began.

For Saudi Arabia, there are plenty of lessons to be learned from all the way back in the 1970s and the days of Rivelino.

Back then, it was members of the royalty who owned clubs and bankrolled the spending – also signing the likes of Zico, Hristo Stoichkov or iconic coach Mario Zagallo. There was no government plan or support. And when the oil prices tumbled and crippled Saudi Arabia’s economy, football quickly became a casualty.

So is this time any different?

Firstly, it’s backed by the seemingly endless coffers of the PIF and the Saudi government, not by individual members of the royalty owning clubs.

Saleh al-Khalif, Al-Riyadiah newspaper’s deputy editor-in-chief, told AFP: “Rivo (Rivelino) came and some other Tunisian players who played well in World Cup 1978. But the experience was eventually a failure.”

“It depended on the honour members of the clubs (royal owners), not a government plan or spending,” he added.

“It was not sustainable so it didn’t survive. This is totally different from the current push.”

Secondly, it’s just part of a much broader strategy. The nation is not just seeking to pour money into the domestic league, but to boost youth development all the way through to the national team – the Green Falcons who stunned eventual champions Argentina at last year’s World Cup.

To that end, the nation has now signed Italian mastermind Roberto Mancini, who stunned his home nation by quitting the national team job to take up the same gig for Saudi Arabia – with a pay cheque worth 25 million euro per year after tax.

The Saudi national team is coming from a much stronger starting point than China, for example, with a current ranking of 57th and a historic best of 21st in the world.

Saudi football president Yasser al-Misehal said: “Roberto believes in Saudi football and our desire to develop top competitive players and take them to new heights on the world stage – including the Asian Cup in Qatar and qualification for the 2026 World Cup … We’re a footballing nation and we [are] continuing to invest at every level in our journey to compete with the best in the world.”

The strategy – and Vision 2030 itself – is long term – especially if you include a potential FIFA World Cup on Saudi soil in 2034.

Just as in the 1980s, Saudi Arabia remains vulnerable to fluctuations in the global oil price, and a major downturn could potentially force the nation to pull back on its football spending. Or there could simply be a change in the government’s approach – like happened in China.

But if Saudi Arabia commits to its current path for the long term, the implications could be immense. Right now, all signs are pointing to this transfer window being just the start.

And when it comes to the players they missed out on, the PIF almost certainly will be back.

Take Liverpool’s talismanic attacker Mohamed Salah, with Al-Ittihad offering a transfer fee valued at £100m rising to £150m with add-ons. Liverpool rejected a move for their star man out of hand, holding firm despite rumours Al-Ittihad would return with a bid potentially valued as high as £200m. The player himself was reportedly offered a salary around £1.5 million a week – four times his current salary which is a Liverpool club record.

Al-Ittihad will almost certainly make another attempt in January’s transfer window, but a move at season’s end is more likely. Salah will then be 32 years old with one season left on his Liverpool contract – making the Reds far more likely to cash in on their star man rather than lose him for free a year later.

HOW BIG IS THE THREAT TO THE CURRENT ORDER?

For all of Saudi Arabia’s spending, it’s worth remembering that many of the traditional leagues were probably the biggest benefactors this transfer window. Clubs that were struggling to meet their financial fair play obligations were more than happy to offload players in return for trumped-up transfer fees – especially the likes of Wolves in the Premier League or even big-spending Chelsea.

That was especially the case with selling ageing players or those with one year remaining on their contracts – the kinds of players that don’t typically attract big transfer fees.

By signing so many Premier League players, Saudi Arabia’s deep coffers essentially helped to fund the Premier League’s record spending spree.

But it’s other leagues that will feel most threatened by the aggressive Saudi transfer strategy, given those clubs have significantly less income – and therefore a greatly reduced ability to compete financially with the spending power of Premier League clubs and Saudi clubs.

Making the battle more one-sided is that Saudi Arabian teams have no financial fair play restrictions – meaning they can spend as much as they want and not have to worry about balancing their books.

UEFA’s financial restrictions and those of the individual European leagues mean the vast majority of European clubs cannot match the wages or the transfer fees offered by Saudi Arabian teams.

Consider this: the four major European leagues behind the Premier League (the German Bundesliga, Italian Serie A, Spanish LaLiga and France’s Ligue 1) ended this transfer window with more income than expenditure – a combined net total of €620.41m!

So while Premier League and Saudi clubs were spending big, the rest of Europe’s big five leagues were far more restricted by financial constraints.

But should the Premier League itself be worried?

Jason Burt wrote in The Times: “Of course players from all around the world come to the Premier League because it is such a well-organised, well-run competition and life is good in England.

“But no-one should kid themselves that they do not mainly come here for the money. And if the money is better in Saudi Arabia and enough of their teammates, countrymen and stars are already there then they will follow.

“Make no mistake what the Saudis are doing represents one of the greatest existential threats European football, and certainly the Premier League, has ever faced.”

However, Premier League chief executive Richard Masters recently said he was not worried about the threat of the Saudi league, saying they could not match the history, fan engagement, and professionalism of the English game.

“I have been asked if I’m concerned by that and you know the answer – it’s something we have to keep an eye on … We are way off worrying about that at the minute,” he said.

For now, the Premier League is benefiting from big transfer fees for players to leave to Saudi Arabia, while simultaneously facing pressure to increase player wages to stop their best players from taking a Middle East payday.

It’s a delicate balance – but there’s no doubt that the Premier League is better poised than European rivals operating on a fraction of the budget of English clubs.

Perhaps the key to the future will lie in the ability of Saudi clubs to convince younger players – those still on the rise or in the peak of their career – to join the competition.

So far, Saudi clubs have mostly signed ageing stars rather than young guns or those in the peak of their careers.

But with every high-profile player that signs on, the allure for younger players grows stronger – especially when the financial incentive is overwhelming.

21-year-old Gabri Veiga was one of the most gifted young guns in Spain’s La Liga, having developed through the Celta Vigo academy to reach the first team. He had been set for a €36m transfer to Italian side Napoli this window – only for Al-Ahli to pip them by paying his €40m release clause and offering him a wage reportedly FIVE times higher than the Italians.

If Saudi Arabia is not just a pre-retirement league but a genuine destination for world-class talent of all ages, it then well and truly threatens the traditional football hierarchy.

And if, as Neymar says, the league is already higher quality than the likes of France’s Ligue 1, a seismic shift has already begun.

But maybe that’s just how football works.

New Saudi national team coach Roberto Mancini said: “The same thing happened in Italy many years ago, lots of big foreign players came to Italy and we improved a lot. It’s good for the Saudi players.”

Former Nigeria international and ex-Chelsea technical director Michael Emenalo was named as the SPL’s inaugural director of football in July. He argued that the league should also be viewed in the same way as the European competitions.

“What Saudi football is doing, is no different from what the Premier League have done. There was a time when it was all about Italy. There was a time when it was all about Spain. What we’re looking for in the industry is an opportunity to compete, and to compete on an even scale and to improve upon whatever exists in the industry,” Emenalo claimed.

“I think the Saudi League offers a new opportunity first and foremost for the entire industry, and I think it will create avenues for good competition and for more development of young talent.

“The world can’t have enough of good footballers, the world can’t have enough of good football, the world can’t have enough competition between rival clubs, between countries, between rival leagues.”